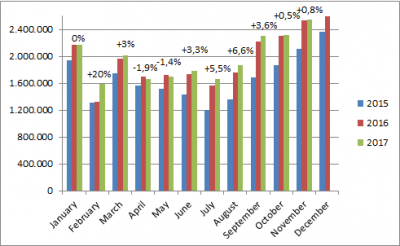

The domestic passenger car market in China edges up by 0,8% in November 2017, to just over 2.55 million sales, the highest volume of the year so far. With such a slow growth rate and a December ahead of us which showed booming growth rate last year, it will be difficult for the Chinese car market to reach its expected 5% growth rate in 2017. Year-to-date sales for the first 11 months are up 3,07% to 21,64 million and we expect the market to be stable again in December, which would give us a total of 24,24 million sales in 2017, up just 2,7% on 2016 and the slowest growth rate in modern history, down from 17,2% last year. At least we can be almost sure the market will show another record year as sales would have to be downby 25% in December for a full-year decline (or down to its 2015 level, which hasn’t happened a single time so far this year). Last December, consumers were rushing to buy new vehicles before the sales tax increase on vehicles with engine sizes of 1.6 liters and below rose from 5% to 7,5% on January 1st, 2017. A similar effect will be noticeable this year, as the tax will increase to 10% on January 1st, 2018.

The domestic passenger car market in China edges up by 0,8% in November 2017, to just over 2.55 million sales, the highest volume of the year so far. With such a slow growth rate and a December ahead of us which showed booming growth rate last year, it will be difficult for the Chinese car market to reach its expected 5% growth rate in 2017. Year-to-date sales for the first 11 months are up 3,07% to 21,64 million and we expect the market to be stable again in December, which would give us a total of 24,24 million sales in 2017, up just 2,7% on 2016 and the slowest growth rate in modern history, down from 17,2% last year. At least we can be almost sure the market will show another record year as sales would have to be downby 25% in December for a full-year decline (or down to its 2015 level, which hasn’t happened a single time so far this year). Last December, consumers were rushing to buy new vehicles before the sales tax increase on vehicles with engine sizes of 1.6 liters and below rose from 5% to 7,5% on January 1st, 2017. A similar effect will be noticeable this year, as the tax will increase to 10% on January 1st, 2018.

Back to November: the only segment to show growth was that of crossovers and SUVs again, which were up by 10% to nearly 1,1 million sales (YTD up 14%), while sedans were down 3,8% to 1.23 million sales (YTD down 1,4%) and MPVs took the biggest hit at -10,3% to 227.000 sales (YTD down 12,5%). Within those sales figures, sales of electric cars and plug-in hybrids (New Energy Vehicles) jumped 83% to 119.000, or 4,7% of the market. Full EVs took the grunt of those sales, rising 75% to 102.000 while PHEVs gained 154% to 17.000 sales. For the first 11 months, EV and plug-in hybrid sales rose 51% to almost 609.000 units, or 2,8% of the total market. The Beijing government has set a target of 6,7% in 2020 and as much as 20% by 2025, helped by a carbon credit scheme that was originally planned to be imposed in 2018 but which has been postponed to 2019. This year, total sales of New Energy Vehicles are expected to top 700.000.

The Seasonally Adjusted Annualized selling Rate in November stood at 26 million, up slightly from the last 2 months and the highest figure this year. The share of domestic automakers in November jumped to 44,5%, up 1,7 percentage points on October and the highest figure since last February, and up mroe than 3 percentage points from 42,3% in November 2016. Sales of domestic brand vehicles across all segments were up 6,1%, compared to a gain of 2,6% for European brands, +0,9% for US brands and +0,5% for Japanese. In contrast, South-Korean brands extended their losing streak to 11 months as they lost 29,8% in November.

After a 7-month absence from the top spot in the models ranking, the Wuling Hongguang reclaims the leadership position it also still holds year-to-date. Its 56.248 sales include about 13.000 units of the new crossover-like Hongguang S3 version (pictured), but are still down 17% on last year. In 2nd place we find the Haval H6 again, topping 50.000 sales for the first time this year and the 5th time ever (after each of the last 4 months of 2016, including almost 80.500 last December), and even with sales of the Haval M6 (#86) included, it is down on last year. For the second time this year and the fifth time ever there’s no sedan in the Chinese top-3, but after a sudden and brief drop to #22 last month, the Volkswagen Lavida is back at the top of the sedan ranking, ahead of the Nissan Sylphy and Buick Excelle GT. After spectacularly claiming the #2 spot in October, the Baojun 510 crossover is down to third place, but still reaches a record volume of nearly 50.000 sales, meaning it sold close to an impressive 305.000 units in just 10 months, which is almost as much as the entire Kia line-up sold so far this year. And Baojun is not depending on only the tremendous success of the 510, as it is the only brand with 3 models in the top-10 this month, with the 730 MPV in 7th place and the 310 small hatchback (and station wagon) breaking its previous ranking (16th) and volume (25.983) records with a #10 position thanks to 31.000 sales.

After a 7-month absence from the top spot in the models ranking, the Wuling Hongguang reclaims the leadership position it also still holds year-to-date. Its 56.248 sales include about 13.000 units of the new crossover-like Hongguang S3 version (pictured), but are still down 17% on last year. In 2nd place we find the Haval H6 again, topping 50.000 sales for the first time this year and the 5th time ever (after each of the last 4 months of 2016, including almost 80.500 last December), and even with sales of the Haval M6 (#86) included, it is down on last year. For the second time this year and the fifth time ever there’s no sedan in the Chinese top-3, but after a sudden and brief drop to #22 last month, the Volkswagen Lavida is back at the top of the sedan ranking, ahead of the Nissan Sylphy and Buick Excelle GT. After spectacularly claiming the #2 spot in October, the Baojun 510 crossover is down to third place, but still reaches a record volume of nearly 50.000 sales, meaning it sold close to an impressive 305.000 units in just 10 months, which is almost as much as the entire Kia line-up sold so far this year. And Baojun is not depending on only the tremendous success of the 510, as it is the only brand with 3 models in the top-10 this month, with the 730 MPV in 7th place and the 310 small hatchback (and station wagon) breaking its previous ranking (16th) and volume (25.983) records with a #10 position thanks to 31.000 sales.

The Geely Boyue is down one spot from October to 11th place but improves its volume record to almost 30.900 sales, and other Geely models also continue to improve their records: the Emgrand GS (#34) tops 17.000 for the first time, its sedan sibling Emgrand GL (#48) passes the 14.000 sales threshold, the v (#53) is above 13.500 sales and the FC Vision sedan (#36) tops 16.000 sales. Other record breakers include the Honda CR-V (#21) with almost 22.000 sales as well as both of its larger siblings UR-V (>6.500) and Avancier (>10.000) in 123rd place and 87th place respectively. The BAIC EC180 consolidates its position as best selling EV in China with a record breaking 15.700 sales at 38th place in November. The Buick GL8 (#47) tops 14.000 sales for the first time, and now has a little sibling with the GL6, introduced last month and already up to 6.900 sales in 117th place. Both FAW’s crossovers Besturn X40 (#75) and Xenia R7 (#81) sell more than 10.000 copies each or the first time, and we can say the same of Great Wall’s upmarket Wey brand, with the VV5 (#79) in only its third month of sales and the VV7 (#82). The BYD Song MAX MPV (#80) also breaks the same threshold in its third month of sales, the Volkswagen Teramont (#69) passes that level as well for the first time, while the Nissan Kicks (#70), Zotye T700 (#76) and GAC Trumpchi GS8 (#85) have been above 10k before but still break their volume records. Just below, the Mitsubishi Outlander (#93) continues to improve and is eyeballing that same level, which the entire Mitsubishi brand had never even reached before exactly 1 year ago. Finally it’s worth mentioning that the China-only BMW 1-Series sedan (#158) has continually improved and has now topped 4.500 monthly sales for the first time.

The Geely Boyue is down one spot from October to 11th place but improves its volume record to almost 30.900 sales, and other Geely models also continue to improve their records: the Emgrand GS (#34) tops 17.000 for the first time, its sedan sibling Emgrand GL (#48) passes the 14.000 sales threshold, the v (#53) is above 13.500 sales and the FC Vision sedan (#36) tops 16.000 sales. Other record breakers include the Honda CR-V (#21) with almost 22.000 sales as well as both of its larger siblings UR-V (>6.500) and Avancier (>10.000) in 123rd place and 87th place respectively. The BAIC EC180 consolidates its position as best selling EV in China with a record breaking 15.700 sales at 38th place in November. The Buick GL8 (#47) tops 14.000 sales for the first time, and now has a little sibling with the GL6, introduced last month and already up to 6.900 sales in 117th place. Both FAW’s crossovers Besturn X40 (#75) and Xenia R7 (#81) sell more than 10.000 copies each or the first time, and we can say the same of Great Wall’s upmarket Wey brand, with the VV5 (#79) in only its third month of sales and the VV7 (#82). The BYD Song MAX MPV (#80) also breaks the same threshold in its third month of sales, the Volkswagen Teramont (#69) passes that level as well for the first time, while the Nissan Kicks (#70), Zotye T700 (#76) and GAC Trumpchi GS8 (#85) have been above 10k before but still break their volume records. Just below, the Mitsubishi Outlander (#93) continues to improve and is eyeballing that same level, which the entire Mitsubishi brand had never even reached before exactly 1 year ago. Finally it’s worth mentioning that the China-only BMW 1-Series sedan (#158) has continually improved and has now topped 4.500 monthly sales for the first time.

Best selling newcomer is obviously the Baojun 510 in 3rd place again, followed by the BAIC EC180, up 16 spots to #38, the Changan CS55, down 2 places to #40 and the Soueast DX3 up 4 to #63.

European brands

After two months above 300.000 sales, market leader Volkswagen is down by 0,4% and drops below that figure again. One of its lower volume models has made a noteworthy progress recently: the China-only flagship sedan Phideon (#210), which had been selling below 1.000 monthly units has suddenly picked up traction since September, topped 2.000 sales in October and now passes the 3.000 sales mark in November. Thanks to great performance of the A4L, luxury sister brand Audi gains 4,5% after two double digit gain months. Including imports, Audi sales increased 6,5 percent to 56.208 . BMW sales rose 12% to 55.293 units including imports, Rolls Royce and Mini (38.109 locally produced, up 22,4%), while Mercedes-Benz sales including imports and Smart increased 22% to 50.813, of which 36.936 locally produced, up 25,7%. Due to Audi’s struggles with some of its dealers in the beginning of the year, BMW is now set to replace it as the best selling luxury brand in China. Year-to-date, BMW Group sales are up 15% to 542.362 units, Mercedes-Benz is catching up quickly from its formely eternal #3 place with a 27% gain to 539.728 sales, while Audi is up just 2,1% to 528.706. In terms of locally produced models, Audi still has a commanding lead over Mercedes-Benz and BMW. Among smaller luxury players Volvo continues its strong form with a 20,5% increase to 8.643 sales in November, Land Rover improves by 14,9% to 6.166 sales of its two locally produced models and sister brand Jaguar sees its sales increase 37,7% to just over 2.000.

After two months above 300.000 sales, market leader Volkswagen is down by 0,4% and drops below that figure again. One of its lower volume models has made a noteworthy progress recently: the China-only flagship sedan Phideon (#210), which had been selling below 1.000 monthly units has suddenly picked up traction since September, topped 2.000 sales in October and now passes the 3.000 sales mark in November. Thanks to great performance of the A4L, luxury sister brand Audi gains 4,5% after two double digit gain months. Including imports, Audi sales increased 6,5 percent to 56.208 . BMW sales rose 12% to 55.293 units including imports, Rolls Royce and Mini (38.109 locally produced, up 22,4%), while Mercedes-Benz sales including imports and Smart increased 22% to 50.813, of which 36.936 locally produced, up 25,7%. Due to Audi’s struggles with some of its dealers in the beginning of the year, BMW is now set to replace it as the best selling luxury brand in China. Year-to-date, BMW Group sales are up 15% to 542.362 units, Mercedes-Benz is catching up quickly from its formely eternal #3 place with a 27% gain to 539.728 sales, while Audi is up just 2,1% to 528.706. In terms of locally produced models, Audi still has a commanding lead over Mercedes-Benz and BMW. Among smaller luxury players Volvo continues its strong form with a 20,5% increase to 8.643 sales in November, Land Rover improves by 14,9% to 6.166 sales of its two locally produced models and sister brand Jaguar sees its sales increase 37,7% to just over 2.000.

Somewhat good news for PSA: after 10 consecutive months of double digit decline, Citroën is down “only” 1% in November, helped by its new C5 Aircross crossover (#119), up to 6.759 sales, close to its sibling Peugeot 4008 in 112th place. Peugeot is still down 19,5% as the 301 (#22, -56,1%) and 408 (#131, -51,4%) sedans take the biggest hits and the 5008 (#225) has lost volume month-over-month for the 4th month in a row. The 5008 is now outsold by its rival Skoda Kodiaq (#120) by a 3-to-1 ratio and even by the Renault Koleos (#196). Skoda sales are up 9,5% in November after four months of decline, and Renault sales are above 6.000 for the 7th time this year.

American brands

For the second month in a row, Buick is in 5th place in the brands ranking, and for the first time ever it’s not the best selling General Motors brand in China, as it’s outsold by Baojun as we’ll discuss that in a separate post. Buick sales are up 2,1%, while sister brand Cadillac has another excellent month even though it has the lowest growth rate in 20 months at +17,7%. Cadillac is still up 65% year-to-date and has already scored its best year ever in China. Chevrolet does even better in November with a 24,4% increase in sales, as the Cavalier (#24) has found its rhythm at 20.000+ monthly sales with the Cruze (#78) also rebounding to over 10.000 sales for the first time this year, which means Chevrolet sales of compact sedans are now finally growing. Initially after its launch, the Cavalier seemed to only cannibalize sales of its sister model with combined sales of the two models only stable at best. Chevrolet also benefits from the addition of the Equinox crossover (#109) which hits a new volume record at nearly 7.600 sales.

For the second month in a row, Buick is in 5th place in the brands ranking, and for the first time ever it’s not the best selling General Motors brand in China, as it’s outsold by Baojun as we’ll discuss that in a separate post. Buick sales are up 2,1%, while sister brand Cadillac has another excellent month even though it has the lowest growth rate in 20 months at +17,7%. Cadillac is still up 65% year-to-date and has already scored its best year ever in China. Chevrolet does even better in November with a 24,4% increase in sales, as the Cavalier (#24) has found its rhythm at 20.000+ monthly sales with the Cruze (#78) also rebounding to over 10.000 sales for the first time this year, which means Chevrolet sales of compact sedans are now finally growing. Initially after its launch, the Cavalier seemed to only cannibalize sales of its sister model with combined sales of the two models only stable at best. Chevrolet also benefits from the addition of the Equinox crossover (#109) which hits a new volume record at nearly 7.600 sales.

Cross-town rival Ford continues to struggle, with a fifth consecutive month of declines and the ninth time this year the brand loses volume on last year. Its year-to-date loss is down to 12%. While the Escort low-cost compact sedan (#12) remains stable, the Focus (#35, -30,6%) is substantially down, but so are the Kuga (#101, -37,8%) and Edge (#100, -36,4%) crossovers. Lincoln, which has just announced it will start local production of the MKX crossover within the next 2 years, but still imports all of its cars at the moment, improves its volume record in China for the fourth time this year and crosses the 6.000 sales barrier for the first time ever as all of its models improve their sales. Ford also announced plans to roll out 50 new Ford and Lincoln models in China by 2025, of which 15 EVs.

Jeep sales seem to have capped at 20.600 sales in March and April as the brand is up just 9% despite having 3 locally produced nameplates now. This is the lowest growth rate since the brand started local production late 2015. The Cherokee (#148, -52,2%) is cannibalized by the Compass (#96), which has its second-best ever month at just over 9.000 sales.

Japanese brands

Honda has its lowest growth rate of the year at +7% even though this is its third-best ever month after December 2014 and 2015. You’ve already read about its record breaking crossover sales above, but Honda’s small sedan sales are tumbling down hard, with the Greiz (#321) down 74,5%, the Gienia (#300) down 65,8% and the City (#139) down 24,5%. Toyota also sees its Vios sedan (#111) struggle at -35,4% but at least it has the new Yaris L sedan (#170) to compensate but combined sales of the two are stable. The Camry midsized sedan (#411) is down to a mere 209 sales as it prepares for the new generation, and as a result Toyota is down 9,4% into 8th place in the brands ranking. That means it’s the #3 Japanese brands with Nissan sales virtually stable. The Sunny sedan (known as Versa in the US) is quickly losing ground in 289th place but that’s compensated by the new Kicks crossover.

Honda has its lowest growth rate of the year at +7% even though this is its third-best ever month after December 2014 and 2015. You’ve already read about its record breaking crossover sales above, but Honda’s small sedan sales are tumbling down hard, with the Greiz (#321) down 74,5%, the Gienia (#300) down 65,8% and the City (#139) down 24,5%. Toyota also sees its Vios sedan (#111) struggle at -35,4% but at least it has the new Yaris L sedan (#170) to compensate but combined sales of the two are stable. The Camry midsized sedan (#411) is down to a mere 209 sales as it prepares for the new generation, and as a result Toyota is down 9,4% into 8th place in the brands ranking. That means it’s the #3 Japanese brands with Nissan sales virtually stable. The Sunny sedan (known as Versa in the US) is quickly losing ground in 289th place but that’s compensated by the new Kicks crossover.

Among smaller Japanese brands, Mazda returns to growth after 3 months of small declines, up 7,1% in November. Mitsubishi scores its best month ever at 12.650 sales but its growth rate is the lowest it’s been since local production of the Outlander (#93) started in August 2016. Suzuki sales are down 9,3% to the second-highest volume so far this year, as the Beidouxing (known as Wagon R in other countries, #155), including the EV version, and facelifted S-Cross (#267) improve their volume. Infiniti sales are down for the 5th time this year at -7% but are still up 5,6% YTD, while Acura sales are at the highest level of the year and the second best ever, even though the TLX-L still hasn’t started deliveries in earnest.

South-Korean brands

If last month we thought the end of the tunnel was in sight for Hyundai, this month the brand is down by 25% again. The only good news I can think of is that its November sales are the highest the brand has seen this year and the brand is back into the top-10. Then again, that’s not much of a consolation for wat used to be the #2 best selling brand in China for years, until as recently as 2015. Again, the brand’s crossovers are struggling the worst, all down by double digits, but also the Elantra Langdon (#71, -61,6%) and the still relatively fresh Verna Yuena (#72, -29,8%). Sister brand Kia is even worse off with sales down 37,1% despite the recent addition of two new nameplates, which both improve their volume records in their third month of sales. The Pegas is up to #122 but cannibalizes the K2 (#212, -85,2%) and the KX Cross is up to #105 but cannibalizes the KX3 (#346, -92,2%). The other crossovers are in trouble too, with the KX5 (#230) down 65,8% and the Sportage R (#193) down 53,1%.

If last month we thought the end of the tunnel was in sight for Hyundai, this month the brand is down by 25% again. The only good news I can think of is that its November sales are the highest the brand has seen this year and the brand is back into the top-10. Then again, that’s not much of a consolation for wat used to be the #2 best selling brand in China for years, until as recently as 2015. Again, the brand’s crossovers are struggling the worst, all down by double digits, but also the Elantra Langdon (#71, -61,6%) and the still relatively fresh Verna Yuena (#72, -29,8%). Sister brand Kia is even worse off with sales down 37,1% despite the recent addition of two new nameplates, which both improve their volume records in their third month of sales. The Pegas is up to #122 but cannibalizes the K2 (#212, -85,2%) and the KX Cross is up to #105 but cannibalizes the KX3 (#346, -92,2%). The other crossovers are in trouble too, with the KX5 (#230) down 65,8% and the Sportage R (#193) down 53,1%.

Chinese brands

Geely has set a new volume record for the brand again, and for any domestic brand for that matter, selling over 143.000 cars in November, which means it has already broken its revised target for the full year, at 1,1 million sales and looks set to reach 1,25 million sales which would also be the highest annual volume of any Chinese brand. Deliveries of the Lynk & Co 01 started in December, but since the company will cap those deliveries until April, it won’t have a huge impact on the ranking yet. Baojun is the second best selling domestic brand in November for the fourth time this year and the second in a row. Both Geely and Baojun improve their sales by about 40%, while Changan, the former best selling domestic automaker, is down 2,7% but is still ahead of Baojun for the year so far. Haval is down 17% but that is compensated by the upscale Wey brand, in its 6th month on the market already outselling established brands like Citroën and Jeep and keeping Great Wall combined sales stable. Wey’s incredible succes is in sharp contrast to Borgward, which even with a second model added to its line-up just can’t seem to top 5.000 monthly sales this year. Helped by the success of the EC180 EV, BAIC sales are up for only the third time this year, at +4,7% even though the brand is still down by almost 20% for the year. Its Huansu subbrand is also up for only the second time this year, thanks to the addition of the Huansu S5 crossover (#149) as well as record sales for the Huansu H2 MPV (#140, +379%), almost 3 years after its launch. Chery and BYD continue to struggle, with their 5th and 8th month of double digit declines respectively, while GAC Trumpchi sales are up by the lowest growth rate ever at “just” 12,3%. The GS4 crossover (#20, -26,3%) is struggling with the increased competition but the expanded line-up makes up for that loss.

Geely has set a new volume record for the brand again, and for any domestic brand for that matter, selling over 143.000 cars in November, which means it has already broken its revised target for the full year, at 1,1 million sales and looks set to reach 1,25 million sales which would also be the highest annual volume of any Chinese brand. Deliveries of the Lynk & Co 01 started in December, but since the company will cap those deliveries until April, it won’t have a huge impact on the ranking yet. Baojun is the second best selling domestic brand in November for the fourth time this year and the second in a row. Both Geely and Baojun improve their sales by about 40%, while Changan, the former best selling domestic automaker, is down 2,7% but is still ahead of Baojun for the year so far. Haval is down 17% but that is compensated by the upscale Wey brand, in its 6th month on the market already outselling established brands like Citroën and Jeep and keeping Great Wall combined sales stable. Wey’s incredible succes is in sharp contrast to Borgward, which even with a second model added to its line-up just can’t seem to top 5.000 monthly sales this year. Helped by the success of the EC180 EV, BAIC sales are up for only the third time this year, at +4,7% even though the brand is still down by almost 20% for the year. Its Huansu subbrand is also up for only the second time this year, thanks to the addition of the Huansu S5 crossover (#149) as well as record sales for the Huansu H2 MPV (#140, +379%), almost 3 years after its launch. Chery and BYD continue to struggle, with their 5th and 8th month of double digit declines respectively, while GAC Trumpchi sales are up by the lowest growth rate ever at “just” 12,3%. The GS4 crossover (#20, -26,3%) is struggling with the increased competition but the expanded line-up makes up for that loss.

Among smaller domestic brands, Venucia has scored its 8th double digit increase thanks to the launch of the D60 sedan (#106), the brand’s best seller by a considerable margin in its first month of sales. For the third consecutive months Hawtai improves its monthly sales volume thanks to the New Santa Fe crossover (#58) as well as the EV160 (#215), two models that have made the brand relevant again before it had completely faded into oblivion. Brilliance scores its first increase of the year at +3,9% and the new V6 crossover (#372) is good looking enough to promise a brighter future for the brand again. Bisu celebrates its first anniversary with record volume of 5.201 sales as the T5 crossover (#190) has proven a hit for the new brand.

Among smaller domestic brands, Venucia has scored its 8th double digit increase thanks to the launch of the D60 sedan (#106), the brand’s best seller by a considerable margin in its first month of sales. For the third consecutive months Hawtai improves its monthly sales volume thanks to the New Santa Fe crossover (#58) as well as the EV160 (#215), two models that have made the brand relevant again before it had completely faded into oblivion. Brilliance scores its first increase of the year at +3,9% and the new V6 crossover (#372) is good looking enough to promise a brighter future for the brand again. Bisu celebrates its first anniversary with record volume of 5.201 sales as the T5 crossover (#190) has proven a hit for the new brand.

New models

This month we welcome 5 new models to the ranking, of which 3 crossovers, 1 sedan and 1 MPV. The Venucia D60 lands just outside the top-100 with 7.821 sales, a promising start for a traditional cheap sedan from a brand with decent recognition but which hasn’t been strong in sedans lately. The D60 is based on the Nissan Sylphy and undercuts the Geely Emgrand GL and Chevrolet Cavalier in price. The Hanteng X5 (#208) is the second model for the brand after the X7 (#165) and its 3.059 sales help the young brand set a new volume record at 7.401 sales. The X5 offers modern styling at an affordable price and promises great things for the future of the brand.  The Geely Vision S1 (#266) is another hatchback/crossover from Geely, positioned above the Emgrand GS. With 1.716 sales it has a lot of room to grow, especially with its modern looks, as all recent Geely models. We’ve briefly touched upon the Brilliance V6, arguably the best looking model of the brand so far and also very promising about what’s more to come from the brand. Finally, the Yema Spica (#437), an MPV that clones the previous generation Toyota Alphard at a fraction of that model’s price. Yema is infamous for its cloning but this must be the most striking example yet. Most shocking is the shark fin B-pillar which is not only a design feature of the current generation Alphard, but is not even real on the Spica: it’s merely painted on. With 60 sales in its first month, I’m not sure what to expect from this model. It’s so cheap and Chinese consumers have proven not to be very bothered about copycat design, so it could be a relative success for the small brand.

The Geely Vision S1 (#266) is another hatchback/crossover from Geely, positioned above the Emgrand GS. With 1.716 sales it has a lot of room to grow, especially with its modern looks, as all recent Geely models. We’ve briefly touched upon the Brilliance V6, arguably the best looking model of the brand so far and also very promising about what’s more to come from the brand. Finally, the Yema Spica (#437), an MPV that clones the previous generation Toyota Alphard at a fraction of that model’s price. Yema is infamous for its cloning but this must be the most striking example yet. Most shocking is the shark fin B-pillar which is not only a design feature of the current generation Alphard, but is not even real on the Spica: it’s merely painted on. With 60 sales in its first month, I’m not sure what to expect from this model. It’s so cheap and Chinese consumers have proven not to be very bothered about copycat design, so it could be a relative success for the small brand.

China brands ranking November 2017

Please note these figures are for locally produced models only (unless stated otherwise), they exclude imported cars, which make up only a small portion of sales in China.

| Brand | 2017-11 | Change | YTD rank | 2017 | Change | |

| 1 | Volkswagen | 292.992 | -0,4% | 1 | 2.881.039 | 5,0% |

| 2 | Geely | 143.848 | 39,4% | 3 | 1.105.030 | 65,3% |

| 3 | Honda | 136.514 | 7,0% | 2 | 1.288.102 | 21,1% |

| 4 | Baojun | 128.486 | 40,5% | 8 | 881.039 | 33,7% |

| 5 | Buick | 125.037 | 2,1% | 4 | 1.093.690 | -1,2% |

| 6 | Nissan | 123.120 | 0,4% | 6 | 996.152 | 10,0% |

| 7 | Changan | 102.952 | -2,7% | 7 | 963.727 | -8,5% |

| 8 | Toyota | 97.493 | -9,4% | 5 | 1.064.728 | 9,5% |

| 9 | Haval | 97.209 | -17,0% | 9 | 760.761 | -5,1% |

| 10 | Hyundai | 95.012 | -25,2% | 11 | 675.948 | -32,1% |

| 11 | Ford | 82.508 | -18,4% | 10 | 749.028 | -12,0% |

| 12 | Chevrolet | 76.055 | 24,4% | 13 | 527.185 | 13,4% |

| 13 | BAIC | 70.694 | 4,7% | 15 | 482.859 | -19,8% |

| 14 | Dongfeng | 65.128 | -6,9% | 12 | 582.338 | -4,1% |

| 15 | Audi | 57.294 | 4,6% | 14 | 518.228 | 1,8% |

| 16 | Wuling | 56.248 | -18,9% | 16 | 474.192 | -18,9% |

| 17 | Kia | 50.003 | -37,1% | 23 | 309.201 | -46,1% |

| 18 | Chery | 48.509 | -28,4% | 19 | 401.141 | -8,0% |

| 19 | BYD | 45.596 | -15,8% | 20 | 352.281 | -19,7% |

| 20 | GAC | 43.324 | 12,3% | 17 | 464.619 | 36,8% |

| 21 | SAIC Roewe | 39.735 | 14,2% | 22 | 347.198 | 71,9% |

| 22 | BMW | 38.109 | 22,4% | 21 | 349.300 | 23,2% |

| 23 | Mercedes-Benz | 36.936 | 25,7% | 18 | 404.169 | 38,4% |

| 24 | Zotye | 36.918 | -6,7% | 26 | 250.793 | -15,1% |

| 25 | Skoda | 36.772 | 9,5% | 24 | 299.362 | -0,9% |

| 26 | Mazda | 32.655 | 7,1% | 25 | 289.402 | 16,9% |

| 27 | Peugeot | 29.836 | -19,5% | 27 | 219.634 | -27,3% |

| 28 | Huansu | 26.371 | 4,1% | 28 | 216.534 | -8,3% |

| 29 | FAW | 26.027 | 6,7% | 31 | 172.809 | 0,0% |

| 30 | JAC | 21.054 | -32,4% | 29 | 200.724 | -39,0% |

| 31 | Wey | 20.460 | New | 47 | 65.078 | New |

| 32 | Citroën | 20.164 | -1,0% | 38 | 112.310 | -48,1% |

| 33 | Hawtai | 18.305 | 236,4% | 39 | 108.158 | 66,5% |

| 34 | Jeep | 17.618 | 8,9% | 30 | 182.081 | 53,3% |

| 35 | Soueast | 17.404 | 17842,3% | 33 | 138.878 | 66,8% |

| 36 | Venucia | 16.923 | 53,8% | 34 | 123.855 | 24,5% |

| 37 | Cadillac | 16.016 | 17,7% | 32 | 159.014 | 64,9% |

| 38 | SAIC MG | 14.363 | 90,2% | 36 | 119.266 | 63,8% |

| 39 | Suzuki | 13.911 | -9,3% | 41 | 102.524 | -26,3% |

| 40 | Haima | 13.015 | -40,7% | 35 | 121.079 | -35,1% |

| 41 | Lifan | 12.923 | -11,1% | 42 | 91.783 | 6,6% |

| 42 | Mitsubishi | 12.650 | 18,6% | 40 | 107.211 | 125,0% |

| 43 | Brilliance | 12.479 | 3,9% | 43 | 84.153 | -43,4% |

| 44 | Leopaard | 11.442 | 15,5% | 37 | 112.348 | 34,5% |

| 45 | Karry | 9.122 | 42,4% | 45 | 74.590 | 20,4% |

| 46 | Volvo | 8.643 | 20,5% | 44 | 81.534 | 30,3% |

| 47 | Hanteng | 7.401 | 45,7% | 51 | 54.003 | 435,4% |

| 48 | Jiangling | 6.412 | 19,1% | 49 | 57.054 | 172,2% |

| 49 | Land Rover | 6.166 | 14,9% | 50 | 55.266 | 23,7% |

| 50 | Renault | 6.006 | 8,9% | 46 | 66.099 | 175,6% |

| 51 | Changhe | 5.277 | -40,3% | 53 | 43.840 | -21,2% |

| 52 | SWM Motor | 5.276 | -16,8% | 48 | 57.619 | 211,1% |

| 53 | Bisu | 5.201 | New | 55 | 41.037 | New |

| 54 | Borgward | 4.778 | -5,0% | 56 | 39.552 | 61,7% |

| 55 | SAIC Maxus | 4.438 | 103,6% | 59 | 27.277 | 62,5% |

| 56 | Zhi Dou | 4.095 | 62,1% | 54 | 41.213 | 123,3% |

| 57 | Qoros | 3.460 | 26,6% | 65 | 13.736 | -35,0% |

| 58 | Jinbei | 3.307 | -36,9% | 52 | 45.730 | -30,5% |

| 59 | Yema | 3.083 | 6,8% | 58 | 27.786 | -7,6% |

| 60 | Enranger (Yingzhi) | 2.596 | -2,3% | 62 | 20.635 | -34,5% |

| 61 | Infiniti | 2.476 | -7,0% | 60 | 24.445 | 5,6% |

| 62 | Luxgen | 2.427 | -18,9% | 64 | 15.633 | -58,1% |

| 63 | Jaguar | 2.013 | 37,7% | 63 | 18.453 | 358,3% |

| 64 | Foton | 1.900 | -32,9% | 61 | 22.027 | 93,5% |

| 65 | Great Wall | 1.616 | -38,1% | 67 | 10.049 | -65,0% |

| 66 | Landwind | 1.600 | -78,7% | 57 | 34.036 | -52,3% |

| 67 | Acura | 1.563 | 20,1% | 66 | 12.152 | 141,5% |

| 68 | Denza | 894 | 304,5% | 71 | 3.506 | 113,7% |

| 69 | DS | 414 | -67,0% | 68 | 5.541 | -62,0% |

| 70 | Jonway | 330 | -51,4% | 69 | 5.046 | -7,9% |

| 71 | Jiangnan | 80 | New | 74 | 2.004 | -43,1% |

| 72 | Qiteng | 52 | -81,0% | 72 | 2.754 | 16,7% |

| 73 | Fiat | 5 | -99,2% | 73 | 2.264 | -81,1% |

| 74 | Huasong | 2 | -99,9% | 70 | 4.226 | 11,9% |

China models ranking November 2017

| Model | 2017-11 | Change | YTD rank | 2017 | Change | |

| 1 | Wuling Hongguang | 56.248 | -17,3% | 1 | 468.804 | -17,4% |

| 2 | Haval H6 | 54.097 | -23,0% | 2 | 450.818 | -9,9% |

| 3 | Baojun 510 | 49.866 | New | 9 | 304.827 | New |

| 4 | Volkswagen Lavida | 47.554 | 11,3% | 3 | 415.507 | -5,8% |

| 5 | Nissan Sylphy | 41.647 | -7,9% | 5 | 360.585 | 11,2% |

| 6 | Buick Excelle GT | 37.993 | 6,9% | 4 | 380.357 | 12,3% |

| 7 | Baojun 730 | 32.061 | -27,7% | 15 | 242.894 | -24,1% |

| 8 | Volkswagen Jetta | 31.850 | 4,6% | 10 | 303.672 | -8,6% |

| 9 | Toyota Corolla | 31.177 | -2,4% | 6 | 317.357 | 13,7% |

| 10 | Baojun 310 | 31.002 | 106,6% | 23 | 184.679 | 474,9% |

| 11 | Geely Boyue | 30.884 | 66,7% | 13 | 254.958 | 187,0% |

| 12 | Ford Escort | 30.826 | -0,7% | 14 | 251.448 | -5,5% |

| 13 | Volkswagen Sagitar | 29.137 | -8,1% | 11 | 297.116 | -6,0% |

| 14 | Volkswagen Tiguan | 28.849 | 10,2% | 8 | 310.448 | 44,0% |

| 15 | Geely EC7 Emgrand | 27.697 | -4,0% | 16 | 234.344 | 10,3% |

| 16 | Volkswagen Santana | 27.516 | -5,3% | 12 | 268.647 | -3,9% |

| 17 | Changan CS75 | 26.456 | 20,4% | 18 | 218.276 | 15,4% |

| 18 | Haval H2 | 26.089 | 0,2% | 21 | 196.605 | 21,6% |

| 19 | Roewe RX5 | 25.245 | 18,3% | 19 | 217.513 | 233,3% |

| 20 | GAC Trumpchi GS4 | 23.651 | -26,3% | 7 | 314.893 | 3,1% |

| 21 | Honda CR-V | 21.953 | 21,9% | 29 | 158.885 | -3,3% |

| 22 | Buick Verano (Wei Lang) | 21.754 | 9,7% | 25 | 165.447 | 5,0% |

| 23 | Buick Envision | 21.453 | -31,1% | 20 | 213.437 | -12,4% |

| 24 | Chevrolet Cavalier | 21.361 | 72,6% | 24 | 168.083 | 367,5% |

| 25 | Volkswagen Bora | 21.351 | -21,7% | 17 | 226.207 | 11,9% |

| 26 | Nissan X-Trail | 20.365 | 4,1% | 26 | 163.751 | 0,3% |

| 27 | Hyundai Elantra Lingdong | 20.332 | 37,8% | 70 | 95.967 | -12,4% |

| 28 | Volkswagen Magotan | 18.435 | 12,8% | 22 | 195.960 | 28,0% |

| 29 | Kia K3 | 18.211 | -30,6% | 48 | 120.251 | -28,5% |

| 30 | Chevrolet Sail | 17.947 | -3,6% | 61 | 107.776 | -8,2% |

| 31 | Dongfeng Fengguang 580 | 17.617 | 13,1% | 28 | 160.766 | 131,1% |

| 32 | Changan CS35 | 17.557 | 34,1% | 38 | 136.306 | -15,4% |

| 33 | Chevrolet Malibu | 17.504 | 48,6% | 63 | 106.860 | 48,3% |

| 34 | Geely Emgrand GS | 17.487 | 73,5% | 42 | 131.634 | 161,7% |

| 35 | Ford Focus | 16.888 | -30,6% | 31 | 156.933 | -21,2% |

| 36 | Geely FC Vision | 16.103 | 11,8% | 44 | 130.481 | 3,8% |

| 37 | Hyundai Tucson | 15.802 | -27,3% | 57 | 111.883 | -27,8% |

| 38 | BAIC EC180 | 15.719 | New | 102 | 64.910 | New |

| 39 | Volkswagen Polo | 15.621 | -3,3% | 30 | 158.563 | -1,5% |

| 40 | Changan CS55 | 15.457 | New | 108 | 62.066 | New |

| 41 | Honda Civic | 15.280 | 31,7% | 27 | 163.029 | 120,8% |

| 42 | Honda Accord | 15.113 | 0,9% | 37 | 137.198 | 11,5% |

| 43 | Hyundai Mistra | 14.903 | -6,6% | 49 | 118.917 | -10,3% |

| 44 | Audi A6L | 14.690 | 6,4% | 39 | 135.735 | 4,8% |

| 45 | Mazda3 Axela | 14.651 | 16,7% | 45 | 128.213 | 4,3% |

| 46 | Skoda Octavia | 14.528 | -13,0% | 51 | 117.805 | -17,3% |

| 47 | Buick GL8 | 14.332 | 58,7% | 40 | 134.750 | 91,0% |

| 48 | Geely Emgrand GL | 14.211 | 42,0% | 59 | 110.021 | 451,9% |

| 49 | Chery Arrizo 5 | 14.116 | -16,8% | 47 | 120.574 | 11,9% |

| 50 | Toyota Levin | 13.967 | 3,7% | 50 | 118.119 | -5,0% |

| 51 | Dongfeng Joyear SUV | 13.872 | 137,4% | 76 | 88.850 | 38,1% |

| 52 | Honda XR-V | 13.820 | -21,8% | 32 | 155.112 | 4,1% |

| 53 | Geely Vision X6 | 13.647 | 24,7% | 55 | 112.389 | 188,8% |

| 54 | Volkswagen Passat | 13.600 | -39,5% | 33 | 147.841 | -9,4% |

| 55 | Toyota RAV4 | 13.352 | -2,0% | 46 | 120.810 | 15,9% |

| 56 | Volkswagen Lamando | 13.277 | -19,6% | 43 | 130.520 | 1,9% |

| 57 | Audi A4L | 13.022 | 64,3% | 58 | 110.296 | 15,9% |

| 58 | Hawtai New Santa Fe | 12.877 | 360,2% | 94 | 73.452 | 133,2% |

| 59 | Soueast DX3 | 12.830 | New | 71 | 94.412 | New |

| 60 | Volkswagen Golf | 12.798 | -20,7% | 35 | 143.211 | -15,5% |

| 61 | Nissan Teana | 12.784 | 14,6% | 67 | 99.059 | 19,6% |

| 62 | Nissan Qashqai | 12.732 | -18,8% | 34 | 143.214 | 13,5% |

| 63 | Baojun 560 | 12.633 | -59,6% | 36 | 139.298 | -51,9% |

| 64 | Honda Vezel | 12.185 | -26,2% | 41 | 133.239 | -10,0% |

| 65 | Audi Q5 | 12.184 | -3,2% | 53 | 115.477 | -5,7% |

| 66 | BMW 5-Series L | 12.126 | -6,1% | 60 | 109.227 | -18,4% |

| 67 | Ford Mondeo | 11.774 | 10,3% | 68 | 98.837 | 10,2% |

| 68 | BMW 3-Series L | 11.456 | 19,7% | 56 | 111.936 | 26,4% |

| 69 | Volkswagen Teramont | 11.238 | New | 103 | 64.675 | New |

| 70 | Nissan Kicks | 10.959 | New | 162 | 36.692 | New |

| 71 | Hyundai Elantra Langdon | 10.870 | -61,6% | 62 | 107.203 | -52,1% |

| 72 | Hyundai Verna Yuena | 10.822 | -29,8% | 90 | 76.397 | 258,5% |

| 73 | Mercedes-Benz C-Class L | 10.738 | 27,8% | 52 | 116.769 | 20,5% |

| 74 | BYD F3 | 10.695 | -38,5% | 54 | 114.309 | 1,3% |

| 75 | FAW Besturn X40 | 10.671 | New | 106 | 63.785 | New |

| 76 | Zotye T700 | 10.510 | New | 139 | 44.550 | New |

| 77 | BYD Song | 10.444 | -35,5% | 75 | 89.993 | 9,9% |

| 78 | Chevrolet Cruze | 10.313 | -8,7% | 98 | 70.850 | -60,2% |

| 79 | Wey VV5 | 10.277 | New | 212 | 22.860 | New |

| 80 | BYD Song MAX | 10.265 | New | 265 | 14.784 | New |

| 81 | FAW Xenia R7 | 10.207 | 35,5% | 121 | 54.975 | 47,0% |

| 82 | Wey VV7 | 10.183 | New | 144 | 42.218 | New |

| 83 | Honda Fit | 10.145 | 6,3% | 66 | 99.529 | -4,2% |

| 84 | Geely Vision X3 | 10.102 | New | 228 | 20.504 | New |

| 85 | GAC Trumpchi GS8 | 10.082 | 302,5% | 74 | 91.716 | 3243,6% |

| 86 | Haval M6 | 10.059 | New | 188 | 27.101 | New |

| 87 | Honda Avancier | 10.007 | 231,1% | 88 | 76.932 | 2007,1% |

| 88 | Honda Crider | 10.003 | 19,3% | 73 | 92.730 | 20,7% |

| 89 | Mercedes-Benz E-Class L | 9.760 | 21,9% | 64 | 104.160 | 120,3% |

| 90 | Nissan Tiida Hatchback | 9.716 | 30,7% | 97 | 71.261 | 117,7% |

| 91 | Audi A3 | 9.584 | -3,0% | 86 | 77.965 | -1,9% |

| 92 | Nissan Lannia | 9.381 | 17,5% | 119 | 55.962 | -20,3% |

| 93 | Mitsubishi Outlander | 9.284 | 63,8% | 91 | 75.706 | 603,4% |

| 94 | Toyota Highlander | 9.278 | 0,4% | 72 | 94.172 | 10,8% |

| 95 | Buick LaCrosse | 9.142 | -9,2% | 77 | 88.540 | 27,3% |

| 96 | Jeep Compass | 9.010 | New | 89 | 76.592 | New |

| 97 | Chery Tiggo 3 | 8.908 | -37,8% | 95 | 72.919 | -30,1% |

| 98 | BAIC Beijing Huansu S3 | 8.786 | 7,1% | 84 | 79.335 | -8,0% |

| 99 | BMW X1 | 8.759 | 22,8% | 82 | 82.048 | 69,8% |

| 100 | Ford Edge | 8.391 | -36,4% | 69 | 98.096 | -10,7% |

| 101 | Ford Kuga | 8.285 | -37,8% | 83 | 81.415 | -24,6% |

| 102 | Mercedes-Benz GLC | 8.271 | 23,4% | 65 | 100.165 | 1393,9% |

| 103 | MG ZS | 8.240 | New | 105 | 64.354 | New |

| 104 | Peugeot 308 | 8.226 | -9,6% | 137 | 45.338 | -30,4% |

| 105 | Kia KX Cross | 7.947 | New | 237 | 18.558 | New |

| 106 | Venucia D60 | 7.821 | New | 341 | 7.821 | New |

| 107 | Audi Q3 | 7.814 | -26,1% | 85 | 78.755 | -4,7% |

| 108 | Hyundai Verna | 7.810 | 30,9% | 171 | 34.021 | -69,4% |

| 109 | Chevrolet Equinox | 7.592 | New | 136 | 45.749 | New |

| 110 | Chery Tiggo 5 | 7.540 | 76,7% | 181 | 29.417 | -43,1% |

| 111 | Toyota Vios sedan | 7.394 | -35,4% | 78 | 88.319 | -17,1% |

| 112 | Peugeot 4008 | 7.273 | 124,1% | 134 | 46.598 | 1205,3% |

| 113 | Mazda CX-4 | 7.228 | 6,6% | 101 | 66.439 | 95,1% |

| 114 | Changan Honor | 7.021 | -33,5% | 81 | 83.789 | -41,2% |

| 115 | Dongfeng Fengxing Lingzhi (Future) | 6.979 | -1,2% | 99 | 68.178 | -20,9% |

| 116 | Zotye T600 | 6.903 | -35,9% | 109 | 61.632 | -41,4% |

| 117 | Buick GL6 | 6.896 | New | 308 | 10.403 | New |

| 118 | Roewe i6 | 6.865 | New | 113 | 57.846 | New |

| 119 | Citroën C5 Aircross | 6.759 | New | 255 | 16.839 | New |

| 120 | Skoda Kodiaq | 6.747 | New | 155 | 37.428 | New |

| 121 | Changan Eado | 6.731 | -36,3% | 80 | 84.296 | -42,4% |

| 122 | Kia Pegas | 6.653 | New | 246 | 17.526 | New |

| 123 | Honda UR-V | 6.586 | New | 156 | 37.359 | New |

| 124 | Changan Oushang A800 | 6.570 | New | 157 | 37.297 | New |

| 125 | Haima S5 | 6.506 | -41,6% | 117 | 56.451 | -37,6% |

| 126 | Hyundai ix25 | 6.318 | -47,3% | 145 | 42.218 | -56,1% |

| 127 | JAC Refine M1 | 6.253 | 8,0% | 110 | 60.868 | 3,7% |

| 128 | Mercedes-Benz GLA | 6.200 | 23,9% | 104 | 64.607 | 4,1% |

| 129 | Skoda Rapid | 6.142 | 8,5% | 114 | 57.707 | -7,8% |

| 130 | Cadillac XT5 | 6.100 | 21,0% | 112 | 59.068 | 99,8% |

| 131 | Peugeot 408 | 6.039 | -51,4% | 126 | 50.376 | -40,9% |

| 132 | Lincoln (import only) | 6.006 | 69,6% | 124 | 51.735 | 83,0% |

| 133 | Mazda6 Atenza | 5.925 | 10,8% | 130 | 48.491 | 54,6% |

| 134 | Buick Regal | 5.762 | -15,4% | 120 | 55.294 | -11,3% |

| 135 | JAC IEV6S | 5.660 | 363,6% | 190 | 26.401 | 589,5% |

| 136 | BAIC Beijing Senova X35 | 5.588 | -51,6% | 154 | 37.531 | -35,1% |

| 137 | Leopaard CS9 | 5.461 | New | 183 | 28.389 | New |

| 138 | Leopaard CS10 | 5.456 | -38,3% | 87 | 77.589 | 4,5% |

| 139 | Honda City | 5.449 | -24,5% | 115 | 57.466 | -7,1% |

| 140 | BAIC Beijing Huansu H2 | 5.339 | 378,8% | 219 | 22.022 | 91,7% |

| 141 | Karry K60 | 5.314 | 102,5% | 138 | 44.830 | 1608,5% |

| 142 | Dongfeng Fengguang 330 | 5.300 | -24,4% | 93 | 73.472 | -17,4% |

| 143 | Venucia T90 | 5.241 | New | 141 | 42.796 | New |

| 144 | Zotye T300 | 5.203 | New | 307 | 10.490 | New |

| 145 | Skoda Superb | 5.149 | -17,9% | 161 | 37.086 | 3,5% |

| 146 | GAC Trumpchi GS3 | 5.138 | New | 271 | 14.131 | New |

| 147 | JAC Refine S3 | 5.135 | -69,0% | 131 | 48.081 | -72,0% |

| 148 | Jeep Cherokee | 5.106 | -52,2% | 96 | 71.913 | -25,6% |

| 149 | BAIC Beijing Huansu S5 | 5.057 | New | 222 | 21.774 | New |

| 150 | Volkswagen C-Trek | 5.006 | -10,6% | 111 | 59.571 | 963,4% |

| 151 | Toyota Yaris L hatchback | 4.977 | -21,3% | 128 | 49.672 | -12,2% |

| 152 | Mazda CX-5 | 4.851 | 4,4% | 135 | 46.258 | 4,9% |

| 153 | BAIC Beijing Huansu H3 | 4.840 | -56,3% | 100 | 67.077 | -28,9% |

| 154 | Chery Tiggo 7 | 4.836 | -55,1% | 118 | 56.309 | 143,4% |

| 155 | Suzuki Beidouxing (Big Dipper) | 4.763 | 55,8% | 205 | 23.802 | -2,9% |

| 156 | Roewe RX3 | 4.740 | New | 357 | 6.286 | New |

| 157 | Cadillac ATS-L | 4.616 | -6,4% | 127 | 50.287 | 54,7% |

| 158 | BMW 1-Series | 4.592 | New | 176 | 31.220 | New |

| 159 | Dongfeng Fengxing SX6 | 4.553 | -46,2% | 165 | 36.230 | 118,1% |

| 160 | Volkswagen Gran Lavida | 4.548 | 141,3% | 123 | 51.791 | -15,1% |

| 161 | Changan CX70 | 4.532 | -55,2% | 79 | 85.143 | 20,6% |

| 162 | Changan CS15 | 4.522 | -56,6% | 116 | 57.313 | -15,2% |

| 163 | Hyundai ix35 | 4.477 | -18,2% | 210 | 23.063 | -64,8% |

| 164 | Citroën C-Elysee | 4.380 | -42,8% | 142 | 42.586 | -45,9% |

| 165 | Hanteng X7 | 4.342 | -14,5% | 125 | 50.944 | 405,1% |

| 166 | Honda Jade | 4.328 | 50,6% | 151 | 38.047 | 28,3% |

| 167 | BYD Qin | 4.258 | 280,9% | 258 | 16.080 | -24,4% |

| 168 | Buick Excelle GX | 4.237 | New | 352 | 6.577 | New |

| 169 | Toyota Levin Hybrid | 4.217 | 63,5% | 163 | 36.422 | 54,7% |

| 170 | Toyota Yaris L sedan | 4.178 | New | 159 | 37.190 | New |

| 171 | Soueast DX7 Bolang | 4.173 | New | 153 | 37.802 | -44,9% |

| 172 | Land Rover Discovery Sport | 4.156 | 13,7% | 150 | 38.260 | 74,0% |

| 173 | Changan Alsvin | 4.116 | -49,6% | 147 | 40.539 | -38,0% |

| 174 | Geely Borui / GC9 | 4.103 | -18,6% | 152 | 38.033 | -17,7% |

| 175 | Volkswagen Sportsvan | 4.096 | -20,1% | 140 | 44.396 | 33,8% |

| 176 | Zhi Dou D2 EV | 4.062 | 573,6% | 146 | 41.155 | 431,4% |

| 177 | SWM X7 | 4.033 | -36,4% | 129 | 48.787 | 163,4% |

| 178 | Dongfeng Fengguang 560 | 4.028 | New | 334 | 8.665 | New |

| 179 | Dongfeng Fengshen AX4 | 4.022 | New | 299 | 11.112 | New |

| 180 | Citroën C3-XR | 4.021 | -29,6% | 229 | 20.225 | -68,0% |

| 181 | JMC E200 | 4.004 | New | 295 | 11.333 | New |

| 182 | Cadillac XTS | 4.000 | 31,7% | 149 | 38.838 | 32,8% |

| 183 | Brilliance H530 | 3.989 | 2021,8% | 272 | 14.080 | 281,2% |

| 184 | Lifan Maiwei | 3.956 | -56,6% | 148 | 39.284 | -5,8% |

| 185 | Honda Elysion | 3.953 | 31,5% | 160 | 37.173 | 35,4% |

| 186 | BAIC Beijing Weiwang M50 | 3.921 | -7,3% | 192 | 26.003 | 353,6% |

| 187 | Karry K50 | 3.808 | 1,4% | 179 | 29.500 | -49,4% |

| 188 | Honda Odyssey | 3.798 | -17,1% | 173 | 33.079 | -4,4% |

| 189 | Toyota Vios FS | 3.756 | New | 174 | 32.493 | New |

| 190 | Bisu T5 | 3.726 | New | 230 | 20.182 | New |

| 191 | Changan Oushang | 3.715 | -64,5% | 107 | 63.695 | -41,1% |

| 192 | Borgward BX5 | 3.669 | New | 274 | 13.704 | New |

| 193 | Kia Sportage R | 3.628 | -53,1% | 184 | 28.241 | -61,3% |

| 194 | Volvo S90 | 3.551 | New | 224 | 21.455 | New |

| 195 | Jeep Renegade | 3.502 | -36,2% | 172 | 33.576 | 52,1% |

| 196 | Renault Koleos | 3.405 | 18,3% | 143 | 42.248 | 1368,0% |

| 197 | Citroën C4 Sedan | 3.405 | -7,8% | 267 | 14.414 | -68,3% |

| 198 | Lifan 320 | 3.403 | New | 391 | 4.082 | 1357,9% |

| 199 | Chery eQ | 3.372 | 4,3% | 231 | 20.134 | 42,9% |

| 200 | Ford EcoSport | 3.338 | -17,2% | 178 | 29.814 | -25,9% |

| 201 | Geely Vision X1 | 3.320 | New | 252 | 17.105 | New |

| 202 | Buick Encore | 3.301 | -59,5% | 158 | 37.289 | -41,1% |

| 203 | Lifan Xuanlang | 3.234 | New | 208 | 23.275 | New |

| 204 | Qoros 5 SUV | 3.231 | 124,8% | 315 | 10.161 | 12,7% |

| 205 | Toyota Crown | 3.145 | 18,4% | 170 | 34.138 | 21,6% |

| 206 | Mitsubishi ASX | 3.125 | -22,1% | 191 | 26.147 | -14,0% |

| 207 | Zotye Z100 | 3.099 | New | 324 | 9.468 | 253,0% |

| 208 | Hanteng X5 | 3.059 | New | 413 | 3.059 | New |

| 209 | MG GS | 3.019 | -17,3% | 177 | 30.304 | -34,0% |

| 210 | Volkswagen Phideon | 3.013 | 282,8% | 313 | 10.316 | 347,4% |

| 211 | Venucia T70 | 2.984 | -64,4% | 133 | 46.839 | -25,2% |

| 212 | Kia K2 | 2.984 | -85,2% | 166 | 36.037 | -72,5% |

| 213 | Chery QQ | 2.970 | 89,3% | 239 | 18.516 | 17,2% |

| 214 | Volkswagen Touran | 2.947 | 2,0% | 182 | 29.132 | -28,7% |

| 215 | Hawtai EV160 | 2.834 | New | 335 | 8.302 | New |

| 216 | BAIC Beijing Weiwang M30 | 2.790 | -58,0% | 186 | 27.862 | -75,3% |

| 217 | Volvo XC60 | 2.743 | -31,1% | 168 | 35.961 | 2,0% |

| 218 | Chery Fulwin 2 | 2.739 | 60,6% | 226 | 21.114 | -49,6% |

| 219 | Maxus G10 | 2.735 | 25,5% | 202 | 24.004 | 43,0% |

| 220 | Peugeot 301 | 2.671 | -56,1% | 189 | 26.700 | -59,6% |

| 221 | Zotye E200 | 2.651 | -24,3% | 270 | 14.263 | 30,4% |

| 222 | Suzuki Vitara | 2.641 | -34,7% | 199 | 24.505 | -33,0% |

| 223 | Renault Kadjar | 2.601 | -1,3% | 204 | 23.851 | 13,0% |

| 224 | Roewe 360 | 2.571 | -70,9% | 132 | 47.344 | -35,3% |

| 225 | Peugeot 5008 | 2.437 | New | 233 | 20.047 | New |

| 226 | JMC Yusheng | 2.408 | New | 175 | 31.953 | New |

| 227 | Brilliance M2 Junjie FRV | 2.400 | 119900,0% | 327 | 9.072 | 11,8% |

| 228 | Kia K4 | 2.393 | 2,4% | 248 | 17.328 | -40,2% |

| 229 | Volvo S60L | 2.349 | -26,4% | 200 | 24.118 | -10,4% |

| 230 | Kia KX5 | 2.312 | -65,8% | 243 | 17.948 | -69,2% |

| 231 | Ford Taurus | 2.311 | -31,5% | 206 | 23.525 | -21,8% |

| 232 | Hyundai Celesta | 2.277 | New | 180 | 29.435 | New |

| 233 | Changhe Freedom M50 | 2.266 | -33,4% | 236 | 19.151 | -32,4% |

| 234 | BAW BJ40 | 2.226 | 163,7% | 244 | 17.634 | 128,1% |

| 235 | BAIC Beijing Senova D50 | 2.222 | 60,7% | 389 | 4.210 | -33,9% |

| 236 | Kia K5 | 2.216 | -57,7% | 196 | 24.849 | -13,9% |

| 237 | Infiniti Q50L | 2.215 | 13,4% | 241 | 18.450 | 15,6% |

| 238 | Nissan Murano | 2.200 | -19,8% | 211 | 22.864 | 27,2% |

| 239 | Geely Gleagle K12 | 2.194 | 240,7% | 340 | 7.858 | 1120,2% |

| 240 | Brilliance H330 | 2.160 | -6,1% | 251 | 17.121 | -33,3% |

| 241 | BAW BJ20 | 2.102 | -45,2% | 256 | 16.793 | 50,7% |

| 242 | Skoda Rapid Spaceback | 2.079 | -7,1% | 203 | 23.918 | -6,1% |

| 243 | Haval H7 | 2.070 | -79,5% | 167 | 36.005 | -5,4% |

| 244 | GAC Trumpchi GS7 | 2.027 | New | 350 | 6.769 | New |

| 245 | Jaguar XFL | 2.013 | 37,7% | 240 | 18.453 | 358,3% |

| 246 | Range Rover Evoque | 2.010 | 17,5% | 253 | 17.006 | 58,0% |

| 247 | Geely King Kong | 1.995 | -53,7% | 169 | 34.201 | -36,8% |

| 248 | Luxgen U5 SUV | 1.994 | New | 412 | 3.060 | New |

| 249 | BAIC Beijing Weiwang S50 | 1.984 | 174,0% | 273 | 13.916 | -32,3% |

| 250 | BYD Yuan | 1.977 | -61,0% | 218 | 22.163 | -45,5% |

| 251 | Haima S7 | 1.946 | 109,7% | 263 | 15.097 | 100,0% |

| 252 | Zotye Damai X7 | 1.932 | New | 227 | 20.917 | New |

| 253 | JAC Refine S2 | 1.925 | -58,0% | 213 | 22.779 | -51,8% |

| 254 | Baojun E100 | 1.915 | New | 361 | 5.875 | New |

| 255 | BAIC Beijing Senova X55 | 1.877 | 11,7% | 377 | 4.967 | -82,9% |

| 256 | MG6 | 1.871 | 308,5% | 416 | 2.967 | 114,7% |

| 257 | Jinbei Grace | 1.860 | 32,5% | 238 | 18.540 | 51,7% |

| 258 | Toyota Prado | 1.843 | -56,5% | 122 | 52.471 | 58,1% |

| 259 | Volkswagen CC | 1.834 | -35,0% | 234 | 19.994 | -26,0% |

| 260 | Yema T70 | 1.819 | -37,0% | 235 | 19.742 | -32,4% |

| 261 | Lincoln MKC (import only) | 1.811 | 27,1% | 245 | 17.608 | 42,7% |

| 262 | BYD e5 | 1.806 | -14,5% | 216 | 22.345 | 69,0% |

| 263 | Chery Cowin X5 | 1.787 | New | 375 | 5.044 | New |

| 264 | Brilliance V3 | 1.772 | -74,6% | 209 | 23.264 | -75,5% |

| 265 | BYD Tang | 1.758 | 11,4% | 280 | 13.042 | -56,4% |

| 266 | Geely Vision S1 | 1.716 | New | 439 | 1.716 | New |

| 267 | Suzuki S-Cross | 1.709 | 100,6% | 275 | 13.320 | 21,6% |

| 268 | Changan Linmax | 1.706 | New | 187 | 27.628 | New |

| 269 | Maxus D90 | 1.703 | New | 409 | 3.273 | New |

| 270 | Dongfeng Fengshen H30 / S30 | 1.696 | -29,4% | 197 | 24.803 | 94,8% |

| 271 | BAIC Beijing Senova X25 | 1.694 | -71,6% | 207 | 23.419 | -69,8% |

| 272 | BAIC Beijing Huansu S6 | 1.687 | -63,1% | 221 | 21.870 | -45,8% |

| 273 | Peugeot 2008 | 1.681 | -24,2% | 300 | 11.085 | -61,0% |

| 274 | Zotye Z300 | 1.664 | -21,0% | 266 | 14.642 | 3,6% |

| 275 | Kia Forte | 1.657 | 186,7% | 346 | 7.038 | 7,9% |

| 276 | Haval H5 | 1.655 | -20,5% | 269 | 14.277 | -31,9% |

| 277 | Honda Spirior | 1.618 | -32,2% | 242 | 18.011 | -13,5% |

| 278 | Great Wall Voleex C30 | 1.616 | -38,1% | 317 | 10.049 | -60,3% |

| 279 | Suzuki Alivio | 1.606 | -29,6% | 250 | 17.164 | -12,6% |

| 280 | Haval H9 | 1.603 | 64,2% | 294 | 11.740 | 17,3% |

| 281 | Dongfeng Fengshen AX5 | 1.571 | New | 261 | 15.480 | New |

| 282 | GAC Trumpchi GA6 | 1.568 | -22,8% | 215 | 22.375 | 91,4% |

| 283 | Acura CDX | 1.562 | 20,1% | 289 | 12.150 | 141,5% |

| 284 | Dongfeng Fengshen AX7 | 1.543 | -78,4% | 164 | 36.257 | -37,5% |

| 285 | Suzuki Beidouxing EV | 1.485 | New | 447 | 1.485 | New |

| 286 | Lincoln MKZ (import only) | 1.444 | 39,4% | 290 | 12.047 | 99,1% |

| 287 | BYD S7 | 1.418 | -60,1% | 220 | 21.875 | -65,4% |

| 288 | BYD E6 | 1.416 | -31,6% | 354 | 6.389 | -64,7% |

| 289 | Nissan Sunny | 1.403 | -86,8% | 185 | 27.961 | -58,6% |

| 290 | Peugeot 3008 | 1.403 | -58,3% | 247 | 17.477 | -55,7% |

| 291 | Hawtai E80 | 1.375 | 4483,3% | 305 | 10.807 | 8343,0% |

| 292 | Lincoln Continental (import only) | 1.370 | New | 319 | 9.917 | New |

| 293 | Skoda Fabia | 1.312 | 129,0% | 286 | 12.260 | 4,9% |

| 294 | Cadillac CT6 | 1.300 | 117,4% | 304 | 10.821 | 111,8% |

| 295 | Chevrolet Trax | 1.283 | -72,4% | 259 | 15.915 | -51,9% |

| 296 | Changhe Q35 | 1.275 | -71,0% | 321 | 9.704 | -21,0% |

| 297 | Haima M3 | 1.266 | -56,7% | 254 | 16.996 | -41,1% |

| 298 | JAC Refine S7 | 1.263 | New | 281 | 12.997 | New |

| 299 | Mercedes-Benz V-Class | 1.259 | 53,0% | 296 | 11.231 | 121,5% |

| 300 | Honda Gienia | 1.255 | -65,8% | 198 | 24.599 | 405,7% |

| 301 | BAIC Beijing Senova D50 EV | 1.255 | -66,7% | 320 | 9.911 | -46,2% |

| 302 | FAW Jumper D60 | 1.253 | 8,8% | 302 | 10.948 | -5,6% |

| 303 | JMC Yusheng S350 | 1.247 | -47,6% | 260 | 15.835 | -2,0% |

| 304 | SWM X3 | 1.243 | New | 332 | 8.832 | New |

| 305 | Lincoln MKX (import only) | 1.242 | 27,6% | 303 | 10.875 | 17,3% |

| 306 | Hawtai Santa Fe | 1.219 | -27,6% | 277 | 13.191 | -26,5% |

| 307 | Nissan NV200 | 1.214 | 25,2% | 339 | 7.992 | -10,4% |

| 308 | Zotye SR7 | 1.211 | -45,9% | 276 | 13.279 | -65,9% |

| 309 | Zotye Zhima E30 EV | 1.201 | -41,2% | 373 | 5.158 | 93,5% |

| 310 | Brilliance H220 | 1.200 | 7900,0% | 378 | 4.966 | 207,5% |

| 311 | Jinbei 750 | 1.193 | -68,9% | 214 | 22.764 | -57,5% |

| 312 | Changan Benni | 1.182 | -79,3% | 194 | 25.803 | -46,0% |

| 313 | BMW 2-Series | 1.176 | -22,1% | 264 | 14.869 | 16,2% |

| 314 | JMC Yusheng S330 | 1.161 | -61,4% | 257 | 16.118 | 235,3% |

| 315 | FAW Besturn B30 | 1.153 | -69,0% | 314 | 10.189 | -73,3% |

| 316 | Changan Ouliwei | 1.123 | 763,8% | 370 | 5.255 | -26,7% |

| 317 | Borgward BX7 | 1.109 | -78,0% | 193 | 25.848 | 5,7% |

| 318 | Changan CS95 | 1.106 | New | 232 | 20.125 | New |

| 319 | Citroën C5 | 1.061 | 584,5% | 347 | 7.007 | 64,7% |

| 320 | Zotye Damai X5 | 1.026 | -85,7% | 223 | 21.709 | -73,5% |

| 321 | Honda Greiz | 1.021 | -75,4% | 195 | 25.709 | -27,7% |

| 322 | Suzuki Swift | 1.019 | -52,8% | 282 | 12.744 | -26,1% |

| 323 | Baojun 630 | 1.009 | 23,2% | 406 | 3.466 | -72,2% |

| 324 | Enranger (Yingzhi) 727 | 985 | 276,0% | 325 | 9.376 | 125,9% |

| 325 | Haima Aishang EV | 981 | New | 399 | 3.703 | New |

| 326 | FAW Besturn B50 | 962 | -83,6% | 297 | 11.153 | -64,9% |

| 327 | Changhe M70 | 949 | New | 312 | 10.324 | New |

| 328 | Bisu T3 | 928 | New | 293 | 11.744 | New |

| 329 | Ford Explorer (import only) | 919 | -34,3% | 292 | 11.834 | -5,7% |

| 330 | BYD F5 Suri | 907 | -62,8% | 288 | 12.159 | -59,6% |

| 331 | Dongfeng Joyear S50 | 904 | 119,4% | 298 | 11.150 | 26,1% |

| 332 | Denza EV | 894 | 304,5% | 404 | 3.506 | 113,7% |

| 333 | Haval H1 | 878 | -87,4% | 249 | 17.321 | -72,9% |

| 334 | Venucia M50V | 873 | New | 301 | 11.077 | New |

| 335 | Changan Alsvin V3 (Yuexiang) | 872 | -58,4% | 268 | 14.318 | -56,5% |

| 336 | Kia Cerato | 871 | 22,5% | 353 | 6.403 | 1,6% |

| 337 | Foton Gratour ix | 864 | -60,0% | 309 | 10.400 | 149,7% |

| 338 | BAIC Beijing Huansu S7 | 835 | New | 464 | 900 | New |

| 339 | Lifan 620 | 831 | 170,7% | 386 | 4.254 | 29,9% |

| 340 | Chery Cowin X3 | 828 | -78,8% | 201 | 24.014 | 20,6% |

| 341 | Lifan X60 | 825 | -62,0% | 329 | 8.962 | -23,5% |

| 342 | Skoda Yeti | 815 | -61,7% | 279 | 13.158 | -45,2% |

| 343 | FAW Besturn X80 | 806 | -73,2% | 333 | 8.772 | -52,7% |

| 344 | Changhe Q25 | 787 | -24,7% | 380 | 4.661 | -69,1% |

| 345 | Haval H8 | 758 | 12,1% | 348 | 6.894 | 3,8% |

| 346 | Kia KX3 | 756 | -92,2% | 323 | 9.470 | -84,7% |

| 347 | BAW BJ212 | 755 | -24,0% | 436 | 1.820 | -75,0% |

| 348 | Hyundai Sonata 8 (YF) | 754 | -75,2% | 284 | 12.624 | -61,8% |

| 349 | Mercedes-Benz Vito | 708 | 61,3% | 344 | 7.237 | 174,3% |

| 350 | Yema T80 | 704 | New | 349 | 6.796 | New |

| 351 | Dongfeng Fengshen E70 | 704 | New | 468 | 835 | New |

| 352 | Ford Everest | 695 | -34,4% | 330 | 8.960 | 52,1% |

| 353 | Suzuki Alto | 688 | -54,6% | 336 | 8.163 | -27,8% |

| 354 | JAC Refine S5 | 674 | -52,5% | 217 | 22.291 | -15,9% |

| 355 | Zotye Z500 | 649 | 9,1% | 393 | 3.990 | -27,7% |

| 356 | Hyundai Santa Fe | 647 | -68,7% | 310 | 10.342 | -48,7% |

| 357 | MG3 | 646 | 17,0% | 322 | 9.692 | -14,5% |

| 358 | Chery E3 | 632 | -69,3% | 311 | 10.332 | -27,6% |

| 359 | Nissan Livina | 632 | -41,9% | 362 | 5.706 | -26,8% |

| 360 | Foton MPX | 630 | 20,7% | 351 | 6.752 | 31,5% |

| 361 | Dongfeng Fengshen AX3 | 622 | -84,6% | 278 | 13.183 | -60,3% |

| 362 | Enranger (Yingzhi) 737 | 613 | -42,3% | 384 | 4.404 | -72,2% |

| 363 | Haima M5 | 603 | -82,2% | 316 | 10.116 | -73,6% |

| 364 | Haima S5H | 600 | New | 462 | 1.020 | New |

| 365 | MG GT | 587 | -79,7% | 291 | 11.949 | -15,3% |

| 366 | Haima M6 | 560 | -77,7% | 318 | 9.976 | -26,9% |

| 367 | Haima V70 | 553 | -46,6% | 343 | 7.256 | 32,1% |

| 368 | Bisu M3 | 547 | New | 326 | 9.111 | New |

| 369 | Enranger (Yingzhi) G3 | 531 | -32,7% | 390 | 4.198 | -59,7% |

| 370 | Lifan X50 | 526 | -72,1% | 385 | 4.373 | -67,8% |

| 371 | Leopaard Q6 | 525 | -50,8% | 355 | 6.370 | -31,2% |

| 372 | Brilliance V6 | 525 | New | 481 | 525 | New |

| 373 | BYD F0 | 509 | -52,7% | 306 | 10.703 | 10,4% |

| 374 | Yema E70EV | 500 | New | 458 | 1.188 | New |

| 375 | Chery Cowin C3 | 485 | -28,1% | 372 | 5.161 | 61,1% |

| 376 | BAIC EX-Series | 485 | New | 388 | 4.212 | New |

| 377 | FAW Jumper A70 | 468 | -31,4% | 411 | 3.159 | -12,0% |

| 378 | Enranger (Yingzhi) G5 | 467 | -14,2% | 425 | 2.657 | 139,4% |

| 379 | BAIC Beijing Huansu S2 | 454 | 32,4% | 426 | 2.458 | -33,0% |

| 380 | Ford Tourneo | 441 | 145,0% | 381 | 4.644 | 210,0% |

| 381 | BAIC Beijing Senova D20 EV | 383 | -47,9% | 367 | 5.420 | -70,8% |

| 382 | Kia KX7 | 375 | New | 365 | 5.550 | New |

| 383 | Dongfeng Succe | 356 | -8,2% | 407 | 3.336 | -38,3% |

| 384 | Geely Gleagle K17A | 342 | New | 401 | 3.648 | 220,6% |

| 385 | GAC Trumpchi GA3S | 338 | -56,9% | 345 | 7.130 | -6,3% |

| 386 | Ford Mustang (import only) | 335 | 48,9% | 395 | 3.869 | 38,6% |

| 387 | Jonway A380 | 330 | -51,4% | 374 | 5.046 | -7,9% |

| 388 | Volkswagen CrossPolo | 322 | 544,0% | 405 | 3.472 | -54,8% |

| 389 | Zotye Z500 EV | 321 | New | 489 | 321 | New |

| 390 | Dongfeng Junfeng ER30 | 315 | New | 371 | 5.215 | New |

| 391 | Roewe 950 | 307 | 143,7% | 418 | 2.780 | 69,5% |

| 392 | Luxgen U6 SUV | 303 | -85,8% | 331 | 8.944 | -68,5% |

| 393 | Dongfeng Junfeng E17 | 300 | New | 491 | 300 | New |

| 394 | GAC Trumpchi GA8 | 292 | -38,0% | 392 | 4.039 | 41,2% |

| 395 | FAW Tianjin Xiali (Charade) | 290 | -81,3% | 358 | 6.158 | -45,9% |

| 396 | Changan Raeton | 278 | -24,9% | 441 | 1.670 | -60,9% |

| 397 | Citroën C6 | 271 | -75,7% | 363 | 5.676 | 173,4% |

| 398 | Brilliance H3 | 269 | New | 360 | 5.932 | New |

| 399 | Citroën C4L | 267 | -86,9% | 364 | 5.563 | -61,4% |

| 400 | Zotye Z700 | 262 | -75,7% | 338 | 8.135 | -31,0% |

| 401 | Soueast V5 Lingzhi | 262 | 181,7% | 396 | 3.859 | -49,3% |

| 402 | Infiniti QX50 | 261 | -63,1% | 359 | 5.995 | -16,7% |

| 403 | Zotye SR9 | 260 | -92,1% | 225 | 21.372 | 550,4% |

| 404 | Jinbei F50 | 254 | New | 383 | 4.426 | New |

| 405 | DS6 | 242 | -64,8% | 419 | 2.767 | -69,6% |

| 406 | Dongfeng Fengshen A30 | 232 | -33,1% | 438 | 1.742 | -61,6% |

| 407 | BAW Yongshi | 229 | 166,3% | 465 | 870 | 103,3% |

| 408 | Qoros 3 | 225 | -75,1% | 420 | 2.761 | -62,6% |

| 409 | Dongfeng Fengshen A60 | 222 | -83,0% | 337 | 8.141 | -63,0% |

| 410 | GAC Trumpchi GE3 | 215 | New | 452 | 1.327 | New |

| 411 | Toyota Camry | 209 | -97,8% | 92 | 73.712 | -20,9% |

| 412 | BAIC Beijing Huansu H5 | 208 | New | 434 | 1.998 | New |

| 413 | Foton Sauvana | 204 | 36,0% | 440 | 1.697 | -7,5% |

| 414 | Foton Gratour im | 202 | New | 410 | 3.178 | New |

| 415 | Chery Cowin V3 | 186 | -88,7% | 356 | 6.299 | -24,6% |

| 416 | Dongfeng Fengshan L60 | 182 | 44,4% | 431 | 2.137 | -5,5% |

| 417 | BAW BJ80C | 180 | 89,5% | 446 | 1.498 | 120,0% |

| 418 | Mitsubishi Lancer EX | 175 | 37,8% | 428 | 2.384 | 96,4% |

| 419 | Buick Velite 5 | 167 | New | 444 | 1.595 | New |

| 420 | Brilliance V5 | 160 | -75,9% | 453 | 1.305 | -84,6% |

| 421 | JAC J5 Heyue | 144 | -90,8% | 369 | 5.256 | -22,3% |

| 422 | FAW Besturn B70 | 142 | -60,0% | 437 | 1.816 | -60,1% |

| 423 | Lincoln Navigator (import only) | 139 | 28,7% | 454 | 1.288 | 112,2% |

| 424 | Soueast V3 Lingyue | 137 | New | 422 | 2.752 | -57,5% |

| 425 | Lifan Lotto | 130 | -84,9% | 408 | 3.275 | -70,3% |

| 426 | Chery Arrizo 7 | 110 | -95,7% | 397 | 3.818 | -68,7% |

| 427 | Dongfeng A9 | 104 | -52,1% | 445 | 1.548 | -3,7% |

| 428 | BYD Qin EV | 98 | -91,9% | 379 | 4.833 | -50,0% |

| 429 | DS 4S | 98 | -63,3% | 459 | 1.129 | -21,3% |

| 430 | Nissan Maxima | 87 | -59,0% | 460 | 1.092 | -51,4% |

| 431 | Jiangnan Alto | 80 | New | 433 | 2.004 | -43,1% |

| 432 | FAW Vita Weizhi Sedan | 75 | -76,9% | 435 | 1.828 | -74,6% |

| 433 | Luxgen 3 | 69 | -86,8% | 430 | 2.299 | -32,3% |

| 434 | Mitsubishi Pajero Sport | 66 | -80,7% | 415 | 2.974 | -16,8% |

| 435 | Peugeot 308S | 66 | -79,0% | 457 | 1.232 | -84,2% |

| 436 | Luxgen M7 MPV | 61 | -66,3% | 463 | 1.006 | -44,6% |

| 437 | Yema Spica | 60 | New | 501 | 60 | New |

| 438 | Volvo S60L PHEV | 58 | New | 474 | 773 | 1617,8% |

| 439 | Chevrolet Lova RV | 55 | -93,6% | 414 | 2.983 | -75,3% |

| 440 | Qiteng EX80 | 52 | -81,0% | 421 | 2.754 | 16,7% |

| 441 | Geely TX4 | 47 | -49,5% | 471 | 810 | -32,6% |

| 442 | DS 5LS | 44 | -81,4% | 455 | 1.278 | -55,1% |

| 443 | Peugeot 508 | 40 | -87,5% | 473 | 781 | -87,9% |

| 444 | BAIC Beijing Senova D80 | 35 | 1650,0% | 495 | 172 | 391,4% |

| 445 | BYD G6 | 34 | New | 423 | 2.731 | New |

| 446 | Zhi Dou D3 EV | 33 | New | 504 | 33 | New |

| 447 | BAIC Beijing Senova D20 | 31 | -11,4% | 403 | 3.552 | 16,5% |

| 448 | DS5 | 30 | -52,4% | 486 | 367 | -69,3% |

| 449 | Zotye Z100EV | 26 | -99,5% | 467 | 867 | -94,1% |

| 450 | Ford Focus ST/RS (import only) | 17 | 30,8% | 492 | 290 | 79,0% |

| 451 | Lifan 820 | 17 | -86,3% | 402 | 3.614 | 89,0% |

| 452 | GAC Trumpchi GA5 PHEV | 13 | -95,8% | 466 | 869 | -70,2% |

| 453 | BYD G5 | 11 | -96,0% | 482 | 498 | -88,4% |

| 454 | BAW Yusheng007 | 9 | -25,0% | 511 | 20 | -95,1% |

| 455 | Changan CS15 EV | 8 | New | 503 | 38 | New |

| 456 | Dongfeng Fengshen E30L | 6 | 0,0% | 508 | 25 | -94,1% |

| 457 | Roewe 350 | 5 | -99,8% | 285 | 12.321 | -68,6% |

| 458 | Venucia R50 / D50 | 4 | -99,8% | 262 | 15.313 | -52,8% |

| 459 | Qoros 3 City SUV | 4 | -99,0% | 469 | 814 | -82,9% |

| 460 | Fiat Ottimo | 4 | -98,1% | 479 | 642 | -86,5% |

| 461 | Brilliance M2 Junjie FSV | 4 | -88,6% | 498 | 161 | -51,2% |

| 462 | BAIC Beijing Senova D70 | 3 | -88,9% | 505 | 31 | -96,9% |

| 463 | Ford F-150 Raptor (import only) | 2 | New | 472 | 797 | New |

| 464 | Huasong7 | 2 | -99,9% | 387 | 4.226 | 11,9% |

| 465 | Roewe 550 hybrid | 2 | -99,8% | 427 | 2.452 | -83,1% |

| 466 | Soueast V6 Lingshi | 2 | -50,0% | 502 | 53 | -90,8% |

| 467 | Fiat Viaggio | 1 | -99,7% | 442 | 1.622 | -77,6% |

| 468 | Lifan 720 | 1 | -95,2% | 507 | 26 | -87,4% |

| 469 | Acura TLX-L | 1 | New | 521 | 2 | New |

Sources: Manufacturers, Chooseauto